When considering U.S. tech investments, QQQ often comes to mind. It’s one of the most popular ETFs, tracking the Nasdaq-100 Index, which comprises 100 of the largest non-financial companies listed on the Nasdaq Stock Market. This includes giants like Apple, Microsoft, NVIDIA, Amazon, Meta, and Alphabet.

But what exactly is the Nasdaq-100 Index?

It’s a market-cap-weighted index emphasizing technology and innovation-driven companies. Financial firms are excluded, focusing instead on sectors like tech, communications, healthcare, and consumer services. The index is rebalanced quarterly to reflect market movements and corporate changes.

💡 What Exactly Are Tech Stocks?

When we say “tech stocks,” we’re talking about companies that:

- Drive digital transformation globally

- Build platforms, chips, software, and AI tools

- Operate in high-growth, high-valuation environments

🔍 Example companies from QQQ:

- Apple (AAPL) – Consumer electronics (iPhone, Mac), services (iCloud, Apple Music)

- Microsoft (MSFT) – Cloud (Azure), enterprise software, AI integration

- NVIDIA (NVDA) – Semiconductors powering AI, gaming, data centers

- Amazon (AMZN) – E-commerce, AWS cloud computing, global logistics

- Meta (META) – Social media (Facebook, Instagram), metaverse, VR

- Alphabet (GOOGL) – Google, YouTube, Android, AI (Gemini), Waymo

These are not traditional manufacturers or financial firms — they’re platform enablers, setting the pace for the future. That’s why QQQ and QQQM are both highly tech-concentrated.

[ Sector Deep Dive (1) – Information Technology: The Force Behind Every Click ]

👉 Read Post

📌 1. Basic Information

| Item | QQQ | QQQM |

|---|---|---|

| Issuer | Invesco | Invesco |

| Inception Date | March 10, 1999 | October 13, 2020 |

| Underlying Index | Nasdaq-100 | Nasdaq-100 |

| Expense Ratio | 0.20% | 0.15% |

| Dividend Frequency | Quarterly | Quarterly |

| Dividend Yield | ~0.59% | ~0.60% |

| Exchange | NASDAQ | NASDAQ |

| Share Price | ~$509.24 | ~$209.66 |

| Average Daily Volume | ~58 million shares | ~3.3 million shares |

📊 Official QQQM Fact Sheet

👉 Invesco NASDAQ 100 ETF (QQQM) Product Detail

✅ 2. Pros & ⚠️ Cons

✅ Pros

- Identical Exposure

→ Both ETFs track the Nasdaq-100 Index, providing access to 100 of the largest non-financial companies listed on the Nasdaq. - Cost Efficiency

→ QQQM offers a lower expense ratio (0.15%) compared to QQQ (0.20%), making it more cost-effective for long-term investors. - Liquidity

→ QQQ boasts higher liquidity with an average daily volume of ~58 million shares, suitable for active traders. - Accessibility

→ QQQM’s lower share price (~$209.66) makes it more accessible for investors looking to invest smaller amounts.

⚠️ Cons

- Liquidity Differences

→ QQQM has lower trading volume (~3.3 million shares daily), which might result in slightly wider bid-ask spreads. - Brand Recognition

→ QQQ has been around since 1999 and is more widely recognized among investors compared to QQQM. - Dividend Yield

→ Both ETFs have relatively low dividend yields (~0.59% for QQQ and ~0.60% for QQQM), which might not appeal to income-focused investors.

📈 3. Historical Performance (CAGR)

-Historical performance of QQQ – Over 866% growth since inception (Source: Google Finance)

| Period | QQQ CAGR | QQQM CAGR |

|---|---|---|

| 3-Year | ~19.63% | ~19.75% |

| 5-Year | ~18.17% | ~13.92% |

| 10-Year | ~17.43% | N/A |

📊 QQQ Performance Details

👉 FinanceCharts.com – QQQ Performance

💰 4. Dividend Growth

| Period | QQQ Dividend CAGR | QQQM Dividend CAGR |

|---|---|---|

| 3-Year | ~11.59% | ~30.00% |

| 5-Year | ~11.09% | Not enough data |

| 10-Year | ~6.78% | Not enough data |

While QQQM appears to have a much higher 3-year dividend growth rate (~30%) compared to QQQ (~11.59%),

this difference is likely inflated due to QQQM’s shorter history and low initial dividend payouts.

Its first few payments were relatively small, which causes percentage-based growth to appear extreme.

In reality, both ETFs pay similar dividends and follow the same index, so long-term dividend growth will likely converge over time.

📊 QQQM Dividend Growth Source

👉 Digrin – QQQM Dividend Growth Rate

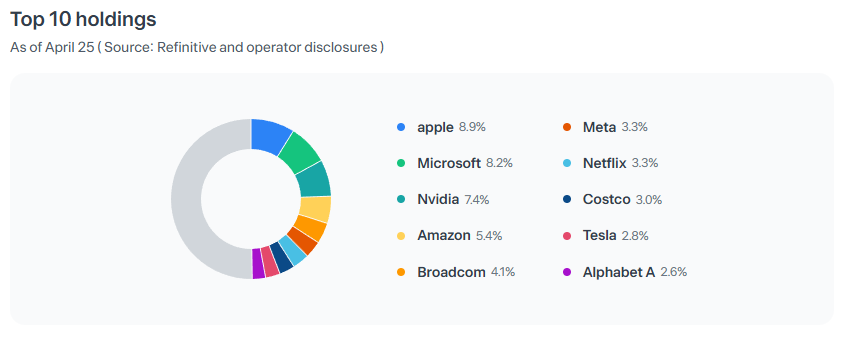

🏗️ 5. Sector Allocation & Top Holdings

– Top 10 Holdings of QQQ as of April 2025 (Source: Toss Securities)

Sector Allocation:

| Sector | Allocation (%) |

|---|---|

| Information Technology | 57.9% |

| Communication Services | 17.6% |

| Consumer Discretionary | 13.3% |

| Healthcare | 6.6% |

| Others | 4.6% |

📊 Sector Allocation Details

👉 Invesco QQQ ETF Holdings

🔄 6. Rebalancing Schedule

- Frequency: Quarterly (March, June, September, December)

- Method: The Nasdaq-100 Index is rebalanced quarterly to reflect market movements and corporate changes.

📊 Nasdaq-100 Rebalancing Details

👉 https://ir.nasdaq.com/news-releases/news-release-details/annual-changes-nasdaq-100-indexr-1

💬 Final Thoughts (My Take)

QQQ and QQQM are two sides of the same coin.

They both give you access to the same 100 innovation-driven companies — Apple, Microsoft, Nvidia, Amazon, Meta, Alphabet — the backbone of the digital economy.

So what’s the difference? It’s not what they hold.

It’s how you use them.

If you’re a short-term trader, focused on liquidity, volume, and options activity, then QQQ is built for you.

But if you’re like me — someone who believes in long-term compounding, consistency, and cost-efficiency — then QQQM makes more sense.

Personally, I have a high allocation to tech. I’ve always believed innovation leads the market over the long run.

That belief kept me calm during the 2022 rate-hike crash.

It kept me steady during the 2025 tariff war panic.

While the headlines screamed fear, I just kept buying.

I didn’t flinch. I didn’t sell.

I knew what I owned. And I trusted the process.

Even when QQQM dipped, I saw it as opportunity — not danger.

Because when you understand the long-term story, you stop reacting emotionally and start acting intentionally.

That’s why I keep accumulating QQQM every single month:

Quietly. Consistently. Confidently.

Because in the end, wealth isn’t built by timing the market.

It’s built by believing in what you own — and sticking with it — step by step.

📎 Related Reads

- 👉 SPDR S&P 500 ETF Trust(SPY):A Comprehensive Overview

- 👉 VOO ETF: The Vanguard Way to Long-Term Wealth

- 👉 IVV ETF: The Quiet Powerhouse of S&P 500 Investing

💼 Disclaimer

This blog post reflects my personal opinions and investing experience. It is not intended as financial advice. Please always do your own research or consult with a licensed advisor before making investment decisions.

📌 Sharing Policy

You’re welcome to share this post or quote parts of it — as long as you credit the original source and include a link back to this blog. Unauthorized copying, pasting, or reposting in full without permission is strictly prohibited.