🤔 Why VOO Is Worth Your Attention

If you’re building a long-term portfolio, chances are you’ve come across VOO, Vanguard’s flagship S&P 500 ETF.

It’s not just popular — it’s trusted. Why?

Because it reflects something deeper than just a list of 500 stocks.

VOO embodies Vanguard’s core philosophy: ultra-low fees, passive growth, and steady dividend reinvestment.

Whether you’re tired of active trading or just want a quiet, consistent way to build wealth over time, VOO offers a smart, low-maintenance path.

Let’s break it down step by step.

📌 1. Basic Information

| Item | Details |

|---|---|

| ETF Name | Vanguard S&P 500 ETF (VOO) |

| Issuer | Vanguard |

| Inception Date | September 7, 2010 |

| Index Tracked | S&P 500 Index |

| Index Type | Market-cap weighted index of 500 U.S. large-cap companies |

| Expense Ratio | 0.03% |

| Dividend Frequency | Quarterly (Mar, Jun, Sep, Dec) |

| Dividend Yield | ~1.30% (as of May 2025) |

| Current Price | ~$543.18 |

| Avg. Volume | ~5 million shares/day |

📊 Basic Info Source 👉 Vanguard Official Site

✅ 2. Pros & ⚠️ Cons

✅ Pros

- Ultra-low cost

At just 0.03%, VOO is among the cheapest ETFs on the market — perfect for long-term compounding. - Vanguard’s unique investor-owned model

Vanguard doesn’t have outside shareholders — it’s owned by its funds, which are owned by investors like you. That means your interests come first. - Ideal for dividend reinvestment

Consistent quarterly payouts and low fees make this ETF great for automated compounding over decades. - Globally trusted by institutions

Many pension funds and endowments use VOO as a reliable long-term core holding.

⚠️ Cons

- Lower liquidity vs. SPY

While still highly liquid, VOO doesn’t quite match SPY’s volume and tight spreads. - Top-heavy concentration risk

As a market-cap weighted fund, VOO can become overly exposed to tech giants like Apple, Microsoft, and Nvidia.

3. 📈 Historical Performance (CAGR)

-Historical performance of VOO – Over 433.68% growth since

📊 Image Source: Google Finance

| Period | CAGR |

|---|---|

| 3-Year | ~10.8% |

| 5-Year | ~12.2% |

| 10-Year | ~12.6% |

Thanks to its low expense ratio, VOO often edges out SPY in long-term returns, even though both track the same index.

📊 Historical Returns 👉 Google Finance – VOO

4. 💰 Dividend Growth

| Period | Avg. Growth Rate |

|---|---|

| 3-Year | ~6.4% |

| 5-Year | ~5.1% |

| 10-Year | ~6.9% |

VOO might not offer a high yield, but its steady dividend growth over the years makes it an excellent candidate for reinvestment and long-term compounding.

📊 Dividend Data 👉 Vanguard – VOO Distribution History

🧩 5. Sector Allocation & Holdings

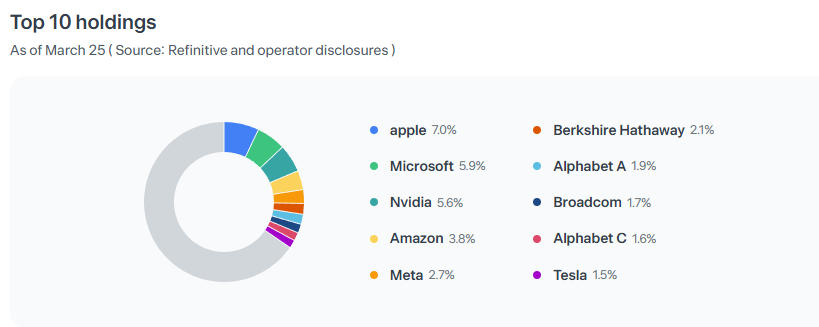

Top 10 Holdings of VOO as of March 2025

📊 Image Source: Toss Securities

- Total Holdings: ~500 companies

- Top Sectors (as of May 2025):

| Sector | Allocation |

|---|---|

| Information Technology | 30.7% |

| Financials | 14.4% |

| Health Care | 10.2% |

| Consumer Discretionary | 10.1% |

| Communication Services | 9.4% |

| Industrials | 8.6% |

| Consumer Staples | 6.1% |

| Energy | 3.1% |

| Utilities | 2.6% |

| Real Estate | 2.2% |

| Materials | 2.0% |

📊 Sector Allocation 👉 Vanguard – VOO Portfolio Composition

🔄 6. Rebalancing Schedule + Real Example

Frequency: Quarterly — March, June, September, December

Rebalancing Criteria:

- U.S.-listed

- Market cap + liquidity

- Positive earnings (profitability filter)

📍 Example: December 2024

- Added: Apollo Global Management, Workday, Lennox International

- Removed: Catalent, Amentum Holdings, Qorvo

These changes are made automatically, with no action needed from investors — truly passive investing at work.

🧠 Is VOO the Right Fit for You?

While many ETFs track the S&P 500, not all are created equal.

What makes VOO stand out isn’t just its ultra-low cost — it’s the Vanguard philosophy that comes with it.

Unlike SPY (managed by State Street) or IVV (managed by BlackRock), Vanguard is mutually owned by its funds. That means the company has no outside shareholders to satisfy — its only responsibility is to its investors.

This unique structure aligns the incentives of fund managers and investors, prioritizing long-term performance and cost-efficiency over short-term metrics or flashy growth.

So, when might VOO be the best fit for your portfolio?

Here are a few real-world scenarios where this ETF truly shines:

🔍 Real-World Scenarios Where VOO Excels

- 📈 Retirement Accounts (IRAs, 401(k)s):

With its low turnover and rock-bottom expense ratio, VOO is an excellent choice for retirement investors looking to maximize compounding over decades. The less you pay in fees, the more your future self gets to keep. - 💸 Dividend Reinvestment Plans (DRIPs):

VOO pays quarterly dividends and has no hidden costs. That makes it perfect for DRIP investors who want to reinvest payouts automatically — without worrying about fees slowly eating away at their gains. - 🏛️ Core Portfolio Holding:

For those who prefer a “set-it-and-forget-it” strategy, VOO provides broad exposure to the U.S. economy through around 500 of the largest American companies.

It’s ideal for investors who want to put 70–90% of their portfolio into a single, stable asset — without managing dozens of tickers.

Whether you’re new to investing or just tired of chasing performance, VOO can serve as the reliable foundation for your financial future.

🧐 7. Other Considerations

✅ Ideal for long-term investors and passive compounding

✅ Excellent for dividend reinvestment and consistent growth

⚠️ U.S.-only — no international diversification

⚠️ Nearly identical to SPY and IVV — no need to hold all three

✍️ Final Thoughts (My Take)

VOO is one of the best ETFs for long-term investors who want to grow their wealth quietly but effectively.

While SPY is an excellent ETF in its own right — and a pioneer in the ETF industry —

I personally find VOO more aligned with my long-term investing philosophy.

Vanguard’s low-cost, investor-first approach gives me more confidence that my money is working efficiently over the decades.

The slight fee difference between SPY and VOO may not seem like much now,

but over 10, 20, or 30 years, it can compound into a meaningful edge.

✔️ For anyone focused on compounding, dividend reinvestment, and true passive growth,

VOO is simply built for the long haul.

📎 Related Posts

- Choosing the Right S&P 500 ETF: SPY vs. VOO vs. IVV vs. SPLG

👉 Read Post - SCHD ETF Deep Dive: A Dividend-Focused Alternative

👉 Read Post

💼 Disclaimer

This blog post reflects my personal opinions and investing experience. It is not intended as financial advice. Please always conduct your own research or consult with a licensed advisor before making investment decisions.

📌 Sharing Policy

You’re welcome to share this post or quote parts of it—please credit the original source and include a link back to this blog. Unauthorized copying, pasting, or full reposting without permission is strictly prohibited.