Why Are So Many Investors Drawn to VTI?

“Which ETF should I buy these days?”

“SPY feels too common, and QQQ seems too volatile…”

“Wouldn’t it be safer to invest in the whole U.S. market?”

I used to ask myself these exact questions.

At first, I only knew big names like SPY and QQQ. But as I dug deeper, one ETF started to stand out: VTI.

It felt like investing not just in a company, or even a sector, but in America itself.

But is VTI really the best answer for long-term investors like us?

Let me walk you through my analysis, backed by data, experience, and a long-term view.

📌 VTI ETF Overview

| Item | Detail |

|---|---|

| Issuer | Vanguard |

| Inception Date | May 24, 2001 |

| Underlying Index | CRSP US Total Market Index |

| Expense Ratio | 0.03% |

| Dividend Frequency | Quarterly |

| Dividend Yield | ~1.5% (as of 2025) |

| Price | Around $260 |

| Avg. Volume | 3M–4M shares/day |

👉 Official VTI Page (Vanguard)

The CRSP index includes large-, mid-, small-, and micro-cap stocks — essentially the entire U.S. equity market.

✅ Strengths

- Exposure to over 4,000 U.S. companies

- Extremely low cost (just 0.03% expense ratio)

- Balanced exposure to both large-cap stability and small-cap growth

- Broad diversification reduces individual stock risk

- Consistent dividends

- Represents the full power of the U.S. economy

- Endorsed by investing legend Paul Merriman as one of the most efficient ETFs for everyday investors

📊 Data Point: There are ~5,000 listed U.S. companies. VTI includes ~4,000 of them

👉 Source: Vanguard Holdings

📊 Data Point: U.S. GDP reached ~$28 trillion in 2024

👉 Source: World Bank

⚠️ Weaknesses

- Higher volatility during downturns due to small-cap exposure

- Limited international diversification

- Currency risk for non-U.S. investors (if the dollar weakens)

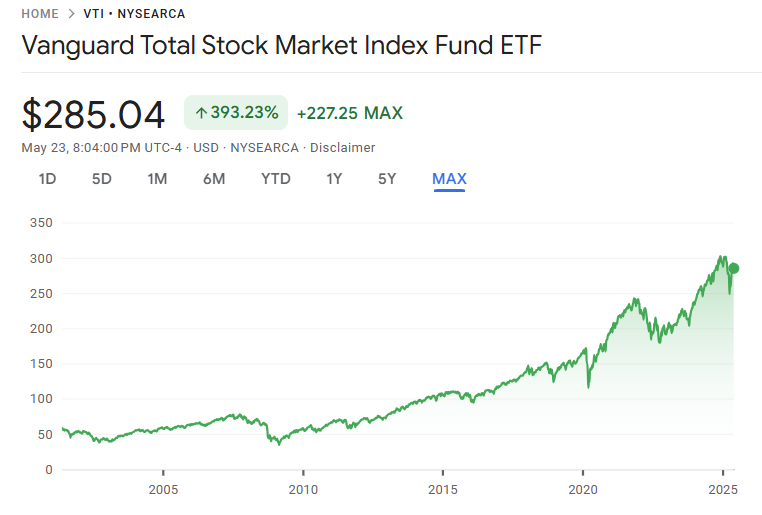

📈 Historical Performance

-Historical performance of VTI – Over 393.23% growth since inception (Source: Google Finance)

| Time Frame | Avg. Annual Return |

|---|---|

| Last 10 Years | ~11.6% |

| Last 5 Years | ~12.4% |

| 2023 | +20.5% |

| 2022 | –19.5% |

| 2020 | +20.99% (SPY was +18.4%) |

👉 Source: Morningstar VTI Performance

💡 Case Study: 2020–2021 Small-Cap Rally

In the aftermath of the 2020 pandemic crash, massive stimulus packages and near-zero interest rates triggered a surge in small-cap stocks.

The Russell 2000 Index, heavily composed of small-cap companies, soared nearly +140% from the March 2020 low to November 2021.

📊 Source: Yahoo Finance

During this time, VTI rebounded even faster than SPY, thanks to its exposure to small- and mid-cap stocks.

💸 Dividend Growth

| Year | Total Annual Dividend |

|---|---|

| 2013 | $1.45 |

| 2023 | $3.27 |

➡️ Annualized Dividend Growth: ~8.3%

A solid hedge against inflation and a source of passive income.

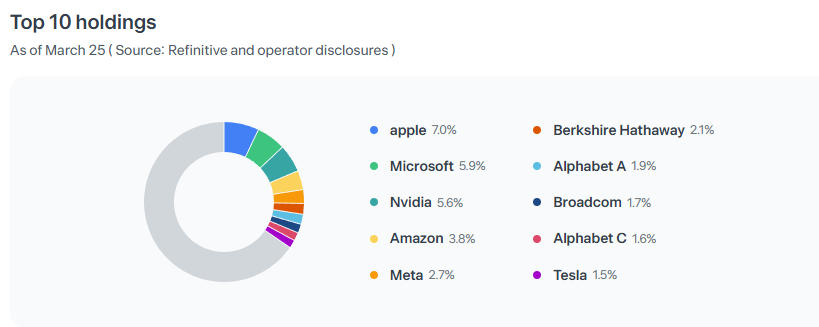

🧬 Sector Allocation & TOP 10 Holdings

| Sector | Weight (%) |

|---|---|

| Technology | 29.2% |

| Financials | 12.9% |

| Healthcare | 12.7% |

| Consumer Discretionary | 10.4% |

| Industrials | 9.3% |

| Communication Services | 8.2% |

| Others (Energy, Utilities, etc.) | 17.3% |

➡️ Total Holdings: ~4,000 stocks

👉 Source: Morningstar Portfolio

🔄 Rebalancing

- Frequency: Quarterly (March, June, September, December)

- How it works: VTI automatically updates its holdings based on changes in the U.S. stock market.

When companies grow or shrink in size, the index adjusts their weight — but instead of doing it all at once, CRSP spreads the changes over 5 days to avoid sudden price swings. - Example: If a small company becomes mid-sized, its share in the index gradually increases over a few days.

👉 See how CRSP handles rebalancing

This kind of gradual adjustment helps you stay diversified — without needing to lift a finger.

🧠 Wisdom from John C. Bogle

VTI isn’t just any ETF — it reflects the timeless philosophy of John Bogle, founder of Vanguard and creator of the first index fund.

“Don’t look for the needle in the haystack. Just buy the haystack.”

— John C. Bogle

“Own the entire market. Do nothing. Just stay the course.”

— John C. Bogle

VTI embodies this strategy perfectly — simple, low-cost, and built for the long term.

💬 My Take

Honestly, I see VTI as “America in a single ticker.”

If the U.S. economy thrives, so will VTI.

And if it crashes? Let’s be real — no ETF will be safe anyway.

Personally, I prefer VTI over S&P 500 ETFs like SPY or VOO. Why?

Because I believe that every giant company once started small.

Apple, Tesla, Amazon — all of them were once small-cap stocks.

VTI allows you to own those companies from the very beginning, ride their growth, and capture the whole journey.

If you want to keep it simple, invest regularly, and let time do the heavy lifting —

VTI is one of the strongest hands you can play.

💼 Disclaimer

This blog post reflects my personal opinions and investing experience.

It is not intended as financial advice. Please always do your own research or consult with a licensed advisor before making investment decisions.

📌 Sharing Policy

You’re welcome to share this post or quote parts of it — as long as you credit the original source and include a link back to this blog.

Unauthorized copying, pasting, or reposting in full without permission is strictly prohibited.