🙋♂️ Looking for the lowest-cost way to invest in the S&P 500?

Everyone knows SPY and VOO. But few talk about SPLG, even though it offers the same exposure — at the lowest fee among them all.

Managed by State Street Global Advisors, SPLG is a no-frills, ultra-efficient ETF that tracks the S&P 500 at just 0.02% expense ratio.

It’s the ETF I personally use. And here’s why.

📌 1. Basic Information

| Item | Details |

|---|---|

| ETF Name | SPDR Portfolio S&P 500 ETF (SPLG) |

| Issuer | State Street Global Advisors (SSGA) |

| Inception Date | November 8, 2005 (tracking S&P 500 since 2020) |

| Index Tracked | S&P 500 Index |

| Expense Ratio | 0.02% |

| Dividend Frequency | Quarterly (Mar, Jun, Sep, Dec) |

| Dividend Yield | ~1.31% (as of May 2025) |

| Share Price | ~$68.13 |

| Avg. Daily Volume | ~1.6 million shares |

📊 Official SPLG Fact Sheet

👉 https://www.ssga.com/us/en/intermediary/etfs/spdr-portfolio-sp-500-etf-splg

✅ 2. Pros & ⚠️ Cons

✅ Pros

- Lowest expense ratio (0.02%)

→ Lower than SPY (0.09%) or VOO (0.03%), which adds up over the long term. - Same exposure, less cost

→ Tracks the same 500 companies in the S&P 500 — but more efficiently. - Low share price

→ Great for beginners, DCA strategies, and small accounts. - Simple and transparent structure

→ Full replication method, rebalanced quarterly. No surprises.

⚠️ Cons

- Lower liquidity than SPY/VOO

→ Slightly wider bid-ask spreads during volatility. - Weaker brand awareness

→ SPLG isn’t as well-known in the media or among beginners. - Past index changes

→ Before 2020, SPLG tracked different indexes. Here’s the history:- 2005–2013: Dow Jones U.S. Large-Cap Total Stock Market Index

- 2013–2017: Russell 1000 Index

- 2017–2020: SSGA Large Cap Index

- 2020–present: S&P 500 Index

The current structure is stable, but older performance data needs context.

3. 📈 Historical Performance (CAGR)

-Historical performance of SPLG – Over 388.47% growth since inception (Source: Google Finance)

- 3-Year CAGR: ~10.8%

- 5-Year CAGR: ~12.1%

- Since S&P 500 switch (2020–2025): ~12.4%

Returns are nearly identical to SPY, VOO, and IVV.

Minor differences usually come from tracking mechanics or trading volume.

📊 Performance Chart

👉 https://www.financecharts.com/etfs/SPLG/performance

💰 4. Dividend Growth

| Period | Growth Rate (CAGR) |

|---|---|

| 3-Year | ~9.06% |

| 5-Year | ~4.09% |

| 10-Year | ~7.84% |

These numbers reflect SPLG’s strong dividend momentum in recent years, especially after aligning with the S&P 500 in 2020.

The long-term growth trend is competitive with other major S&P 500 ETFs, while offering better reinvestment efficiency due to lower fees.

📊 Dividend Growth Source

👉 https://www.financecharts.com/etfs/SPLG/dividends/dividends-cagr

The real edge is in reinvestment efficiency and cost structure.

5. Sector Allocation & Holdings

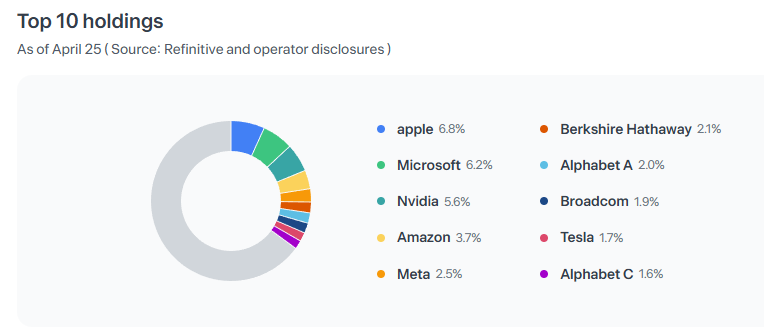

Top 10 Holdings of SPLG as of April 2025 (Source: Toss Securities)

- Total Holdings: 500

- Sector Allocation (as of May 2025):

| Sector | Allocation |

|---|---|

| Information Technology | 31.46% |

| Financials | 14.32% |

| Health Care | 10.67% |

| Consumer Discretionary | 9.61% |

| Communication Services | 9.6% |

| Industrials | 8.77% |

| Consumer Staples | 5.91% |

| Energy | 3.07% |

| Utilities | 2.51% |

| Real Estate | 2.12% |

| Materials | 1.96% |

📊 Official Holdings & Allocation

👉 https://www.ssga.com/us/en/intermediary/etfs/spdr-portfolio-sp-500-etf-splg

🔄 6. Rebalancing Schedule & Example

- Frequency: Quarterly (Mar, Jun, Sep, Dec)

- Method: Full replication, matching S&P 500 changes exactly

📌 December 2024 Example:

- ✅ Added: Apollo Global, Workday, Lennox International

- ❌ Removed: Catalent, Amentum Holdings, Qorvo

📊 Rebalancing Update

👉 https://ntam.northerntrust.com/united-states/all-investor/insights/point-of-view/2025/december-sp-500-index-rebalance-market-sentiment-high-tech-trends-continue

8. ✍️ Final Thoughts (My Take)

SPLG isn’t flashy. It doesn’t make headlines.

But honestly? That’s why I like it.

While others chase the most popular tickers, I focus on what makes my money grow smarter — and cheaper.

SPLG lets me invest in the exact same companies as SPY and VOO, but with less cost and more flexibility.

Over 10, 20, or 30 years, those small fee differences compound into something huge.

And because it trades at a lower price per share, I can consistently invest every month, without worrying about fractional shares or breaking my budget.

If you’re like me — someone who values efficiency over hype —

SPLG just might be the best S&P 500 ETF you’ve never heard of.

📎 Related Reads

- SPY ETF – The Original S&P 500 Powerhouse

- ‘VOO ETF – Vanguard’s Long-Term Investing Philosophy

- IVV ETF – A Quiet But Powerful Core Holding

💼 Disclaimer

This blog post reflects my personal opinions and investing experience.

It is not intended as financial advice. Please always do your own research or consult with a licensed advisor before making investment decisions.

📌 Sharing Policy

You’re welcome to share this post or quote parts of it — as long as you credit the original source and include a link back to this blog.

Unauthorized copying, pasting, or reposting in full without permission is strictly prohibited.