Historical performance of smh – Over 494.59% growth since inception (Source: Google Finance)

🤔 Why Consider SMH?

If you want to invest in the future of technology — AI, data centers, smartphones, EVs, and more — then semiconductors are where it all begins.

Instead of guessing which chip stock will win next, VanEck’s SMH ETF gives you targeted exposure to the world’s biggest and most innovative semiconductor companies.

Let’s break it down step by step.

📌 1. Basic Information

| Item | Details |

|---|---|

| ETF Name | VanEck Semiconductor ETF (SMH) |

| Issuer | VanEck |

| Launch Date | December 20, 2011 |

| Index Tracked | MVIS US Listed Semiconductor 25 Index |

| Expense Ratio | 0.35% |

| Dividend Frequency | Annually (typically December) |

| Dividend Yield | ~0.43% (as of 2024) |

| Share Price | ~$247.29 (as of May 2025) |

| Avg. Daily Volume | ~7 million shares/day |

📊 Official Source 👉 VanEck – SMH ETF

✅ 2. Pros & Cons

✅ Pros

- Concentrated exposure to top semiconductor names

Includes Nvidia, TSMC, ASML, Broadcom, and more — the dominant players driving global chip innovation. - Global reach

Not limited to U.S. firms — adds international leaders like TSMC (Taiwan) and ASML (Netherlands) for broader exposure. - High liquidity

With millions of shares traded daily, SMH is easy to buy and sell — even for larger accounts. - Simple, large-cap focused structure

Its 25-company portfolio is easy to understand and heavily tilted toward the most influential chipmakers.

⚠️ Cons

- Limited diversification

Only 25 holdings = concentrated risk. - Top-heavy structure

The top 5 companies make up more than 50% of the portfolio — meaning one or two stocks can drive (or drag) overall returns. - ADR exposure

TSMC is held via ADRs (American Depository Receipts), which can involve foreign tax complexities. - No big U.S. tech names

Companies like Apple, Microsoft, and Amazon aren’t included — this fund is pure-play semiconductor only.

3. Historical Performance (CAGR)

| Period | Return (Annualized) |

|---|---|

| 10-Year | ~25% |

| 5-Year | ~28% |

| 1-Year | ~50% |

📊 Source 👉 VanEck – SMH Performance Page

💰 4. Dividend Growth

| Year | Dividend ($) |

|---|---|

| 2020 | 0.75 |

| 2021 | 0.79 |

| 2022 | 1.20 |

| 2023 | 1.04 |

| 2024 | 1.07 |

🔎 Note: While not a dividend-focused ETF, SMH’s annual payout has shown gradual growth over time.

📊 Source 👉 VanEck Dividend History

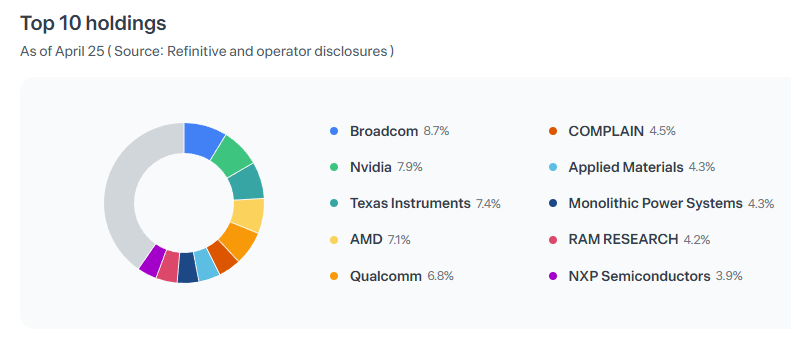

5) Sector Composition – What Each Company Does

SMH holds 25 companies in the semiconductor industry. Here’s a quick breakdown of their roles:

- Nvidia (NVDA) – GPU and AI chip design

- Taiwan Semiconductor (TSMC) – Leading pure-play foundry (contract manufacturing)

- Broadcom (AVGO) – Connectivity and data center chips

- ASML (ASML) – Lithography equipment for chip manufacturing

- Applied Materials (AMAT) – Semiconductor production equipment and services

- AMD (AMD) – CPUs and GPUs

- Qualcomm (QCOM) – Mobile chips and communication technologies

- Analog Devices (ADI) – Analog and mixed-signal chips

- KLA Corp (KLAC) – Process control and inspection equipment

- Texas Instruments (TXN) – Analog chips and embedded processors

- Micron (MU) – Memory chips: DRAM and NAND

- Lam Research (LRCX) – Wafer fabrication equipment

- Intel (INTC) – CPUs and semiconductor manufacturing

- Cadence (CDNS) – Electronic Design Automation (EDA) software

- Synopsys (SNPS) – EDA tools and semiconductor IP

- Marvell (MRVL) – Storage, networking, and connectivity chips

- NXP (NXPI) – Automotive and secure connectivity chips

- Microchip (MCHP) – Microcontrollers and analog solutions

- Monolithic Power Systems (MPWR) – Power management chips

- STMicroelectronics (STM) – Sensors and analog components

- ON Semiconductor (ON) – Power semiconductors and sensors

- Teradyne (TER) – Semiconductor testing equipment

- Skyworks (SWKS) – Wireless connectivity chips

- Qorvo (QRVO) – RF and 5G wireless components

- Universal Display (OLED) – OLED materials and technology

Source: VanEck, ETF.com

6. Rebalancing Schedule & Real-World Examples

- Frequency: Quarterly

- Method: Market cap + liquidity weighted per MVIS methodology

📌 Notable Events:

- Nvidia’s 2023 surge caused its weight to balloon

- In 2022, ASML and AMD underperformed; Broadcom gained relative weight

📊 Index Methodology 👉 MVIS Index Rules (PDF)

7. Other Considerations

- SMH vs. SOXX:

SMH includes global exposure (e.g., TSMC, ASML), while SOXX is U.S.-only. - TSMC via ADR:

TSMC is held in the form of an ADR (American Depositary Receipt), which allows U.S. investors to access foreign stocks.

However, this structure can involve foreign tax withholding on dividends and may come with minor structural differences compared to direct U.S. stocks. - High concentration = High volatility:

SMH is more aggressive than broader tech ETFs like QQQ — it’s built for focused exposure, not balance.

🧠 My Take

SMH offers focused access to global semiconductor leaders — especially companies like Nvidia, TSMC, and ASML.

It’s a great fit for investors who want to ride the semiconductor wave without picking individual stocks.

That said, SMH’s recent performance was largely driven by Nvidia’s explosive growth. Whether this trend continues is uncertain.

The semiconductor industry is inherently cyclical:

- When demand surges, prices and profits skyrocket

- When oversupply or slowdowns hit, the sector can fall hard

Still, as the backbone of modern tech — AI, smartphones, data centers, EVs, robotics — semiconductors are here to stay.

SMH gives you a way to invest in that backbone directly.y.

See you in the next post! 🚀

Step by step — that’s how we build something lasting

📎 Related Reads

- SOXX ETF: An Easy Way to Invest in the Semiconductor Industry

👉 Read Post - SMH vs. SOXX vs. SOXQ: Which Semiconductor ETF Suits You Best?

👉 Read Post

💬 What Do You Think?

Have you invested in SMH — or do you prefer more diversified funds like QQQ or VTI?

Or maybe you like to build your own tech portfolio?

👇 Share your thoughts in the comments! Let’s learn from each other.

💼 Disclaimer

This blog post reflects my personal opinions and investing experience.

It is not intended as financial advice. Please always conduct your own research or consult with a licensed advisor before making investment decisions.

📌 Sharing Policy

You’re welcome to share this post or quote parts of it — please credit the original source and include a link back to this blog.

Unauthorized copying, pasting, or full reposting without permission is strictly prohibited.