Gold has long been a symbol of wealth and security. If you’re looking for protection against inflation or a buffer during market volatility, SPDR Gold Shares (GLD) offers a simple and trusted path to gold exposure.

📌 1. Basic Information

- ETF Name: SPDR Gold Shares (GLD)

- Issuer: State Street Global Advisors

- Inception Date: November 18, 2004

- Underlying Index: LBMA PM Gold Price

- Expense Ratio: 0.40%

- Dividend Yield: None

- Distribution Frequency: Not applicable

- Current Price (as of May 2025): ~$190

- Average Daily Volume: Over 6 million shares

🧐 What is the LBMA PM Gold Price?

The London Bullion Market Association (LBMA) sets the global benchmark price of gold twice daily through an auction-style system among major global banks.

It’s considered a trusted and transparent indicator for gold prices worldwide.

✅ 2. Advantages of GLD

- Direct exposure to physical gold

- Highly liquid and widely traded

- No need to worry about storing or insuring physical gold

- Acts as a hedge in times of crisis or inflation

- Gold bars are securely stored and audited in London (HSBC vault)

⚠️ 3. Disadvantages

- No dividend or yield

- Higher expense ratio (0.40%) compared to alternatives like IAU (0.25%) or GLDM (0.10%)

- No physical redemption for retail investors

- In the U.S., taxed as a “collectible” with a potential capital gains rate of up to 28% (Note: This generally doesn’t apply to non-U.S. residents)

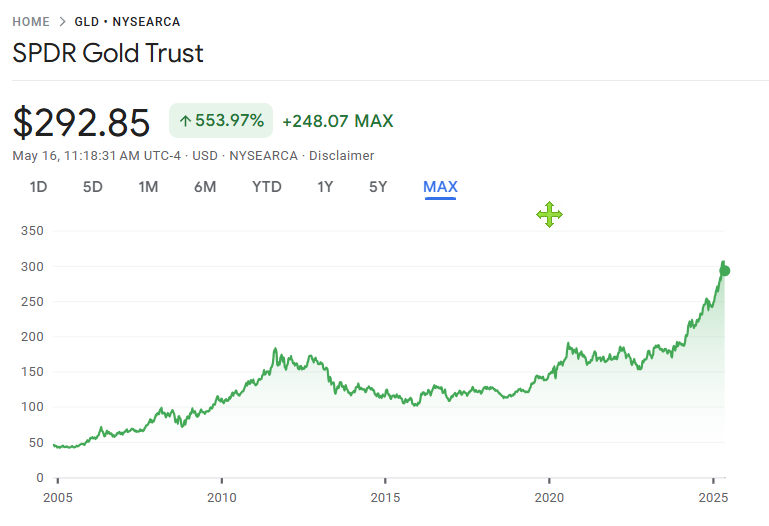

📈 4. Historical Performance

- 1-Year Return (2024–2025): +21.3%

- 5-Year CAGR: ~8.5%

- 10-Year CAGR: ~4.2%

Gold has consistently proven its strength during uncertain times — such as the 2008 financial crisis, the 2020 pandemic, and most recently, global tensions and inflation in 2024–2025.

📉 5. Dividend Growth — There Isn’t Any

GLD pays no dividends because gold doesn’t produce income.

Still, many investors include it for:

- Wealth preservation

- Portfolio diversification

- Performance during market downturns

6. Structure and Holdings

- GLD holds 100% physical gold bars

- Stored in HSBC vaults in London

- Ownership is fractional through a trust

- As of May 2025, GLD holds over 900 metric tons of gold

🔄 7. Rebalancing

GLD doesn’t rebalance like a stock ETF. Instead:

- Shares are created or redeemed based on demand

- This mechanism keeps GLD’s price closely aligned with actual gold value

Example: During COVID-19 in 2020 and the geopolitical tensions of 2023, GLD saw major inflows and increased its gold holdings significantly.

🔥 8. Why Is Gold Booming Right Now? (2024–2025)

Key Reasons:

- Central bank buying (de-dollarization strategy)

- Geopolitical instability

- Negative or low real interest rates

- Weakening U.S. dollar

- Rising demand from retail and ETF investors

🌍 Who’s Buying All This Gold?

| Buyer Type | Reason |

|---|---|

| Central Banks | Reserve diversification, reduce USD reliance |

| Institutional Funds | Hedge portfolios, preserve capital |

| Retail Investors | Crisis hedge, inflation worries |

| Sovereign Wealth | Long-term value store |

| Asian Demand | Cultural + strategic (China, India, etc.) |

🤔 Final Thoughts (Including My Perspective)

GLD may not offer the excitement of tech stocks or the income of dividend ETFs.

But it provides something just as important — stability in chaos.

Here’s my honest take:

I used to invest 100% in stocks because historical data showed that was the best path to long-term growth.

But recently, I’ve noticed a shift. Gold’s performance has been stronger than stocks in the short term,

and the global demand signals a trend reversal that I can’t ignore.

So while I won’t abandon stocks, I’ve decided to allocate around 5% of my portfolio to gold.

It’s a small change, but one I believe can make a big difference when markets shake.

📝 Disclaimer & Final Notes

Just to be clear — I’m not a financial advisor.

I’m simply sharing my personal investing journey here.

Please do what feels right for you. 🙂

Thanks for reading — and as always, invest smart and stay consistent.

See you in the next post! 🚀

Step by step — that’s how we build something lasting.

🔗 Sharing is welcome — but please credit the source (investorJB.com) when you do.