🌟 Gold Isn’t Just Gold Anymore — Choosing Wisely in 2025

“Aren’t all gold ETFs basically the same?”

It’s a common thought — and it makes sense.

If they all track the same gold price, what difference does it make?

But here’s the truth: in 2025, small differences matter more than ever.

With inflation creeping back, geopolitical risks on the rise, and volatility shaking even tech giants, many investors are seeking something stable — something real.

That’s where gold comes in.

And while GLD, IAU, and GLDM all give you exposure to gold, they do it with different costs, structures, and benefits.

Let’s compare them and help you figure out which one fits you best.

📘 1. ETF Overview: GLD vs IAU vs GLDM

| Feature | GLD | IAU | GLDM |

|---|---|---|---|

| Issuer | State Street (SPDR) | BlackRock (iShares) | State Street (SPDR) |

| Launch Date | Nov 2004 | Jan 2005 | Jun 2018 |

| Tracks | Gold Spot Price | Gold Spot Price | Gold Spot Price |

| Expense Ratio | 0.40% | 0.25% | 0.10% |

| Dividend | None | None | None |

| Price (May 2025) | ~$302 | ~$60 | ~$20 |

| Avg Daily Volume | Very High | High | Moderate |

💡 Though they track the same metal, fee structures and liquidity can cause long-term divergence in investor outcomes — especially for buy-and-hold investors.

📊 Source: ETF Providers – SSGA & iShares | BlackRock ETF Center

✅ 2. Pros and ⚠️ Cons Breakdown

✅ GLD – Pros

- Most recognized and longest-standing gold ETF

- Extremely high liquidity — ideal for institutional trading

- Largest asset size and tight bid/ask spreads

- Well-suited for short-term or tactical moves

⚠️ GLD – Cons

- Highest expense ratio (0.40%)

- High share price limits flexibility for smaller portfolios

- Least cost-efficient for long-term holding

✅ IAU – Pros

- Lower fee (0.25%) than GLD — more efficient over time

- Managed by BlackRock, known for stability and trust

- Affordable share price (~$60) allows fractional or DCA-friendly investing

- Strong liquidity for most investor needs

⚠️ IAU – Cons

- Slightly wider bid/ask spread than GLD

- Less institutional volume than GLD

- Marginally higher fee than GLDM

✅ GLDM – Pros

- Lowest fee (0.10%) = best long-term compounding potential

- Ideal for retail investors, especially dollar-cost averaging

- Backed by physical gold, same as GLD and IAU

- Affordable share price (~$20) → flexible entry

⚠️ GLDM – Cons

- Shortest track record (launched 2018)

- Lowest volume → may have wider bid/ask spreads

- Less name recognition among advisors and institutions

📊 Source: SSGA GLDM Page

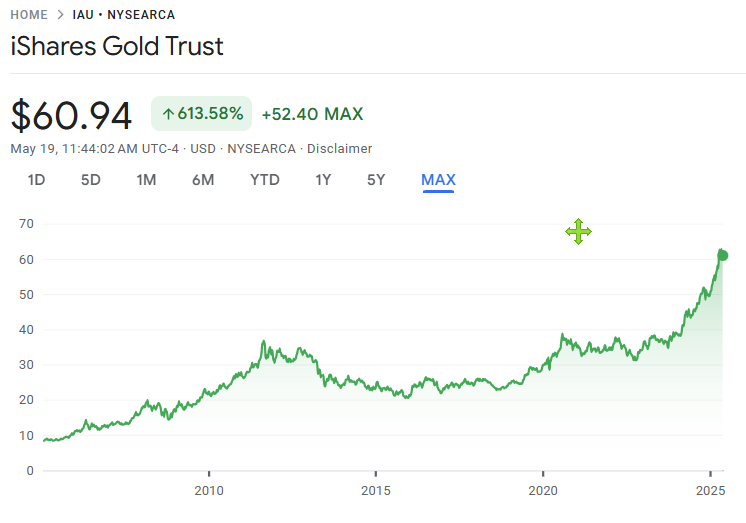

📈 3. Historical Performance: Gold Is Quiet, But Powerful

| Period | GLD | IAU | GLDM |

|---|---|---|---|

| 1-Year | +21.3% | +21.3% | +21.5% |

| 5-Year (Cumulative) | +106.8% | ~+107% | ~+109% |

| Since Launch | +240% | +240% | +65% (launched 2018) |

💡 GLDM edges ahead slightly due to lower expense ratio, despite tracking the same gold price.

📊 Source: Morningstar Performance Tools

💸 4. Dividends? Not with Gold ETFs

None of these ETFs pay dividends.

Since gold doesn’t generate income, your return comes solely from price appreciation — typically as a hedge against inflation, currency devaluation, or global shocks.

🔍 5. Are These Really Backed by Gold?

Yes — and that’s the key difference from futures-based funds.

Each ETF stores physical gold in approved vaults (e.g., HSBC, JP Morgan), located in London or New York.

This means you’re not betting on contracts — you own a slice of real, stored bullion.

💡 If the ETF provider ever went under, the gold stays safe. It’s held separately in trust — not commingled with company assets.

🔄 6. Do They Rebalance?

Not in the traditional sense.

These are single-asset ETFs.

However, fund managers adjust holdings when investors buy or sell — to maintain the gold-to-share ratio.

📌 Example: If there’s a large inflow into GLD, the trust purchases more physical gold to reflect that.

🎯 7. Which ETF Fits Your Strategy?

| Investor Type | Best ETF | Reason |

|---|---|---|

| Active Traders | GLD | Highest liquidity and name recognition |

| Balanced Holders | IAU | Lower fee + strong credibility |

| Long-Term DCA Investors | GLDM | Ultra-low fee + flexible entry point |

💬 My Take – I’m Sticking with GLDM

I personally invest in GLDM through a dollar-cost averaging strategy.

I started during the market uncertainty of 2022, and ever since then, this small gold position has brought peace of mind — especially during market dips in stocks and crypto.

GLDM isn’t flashy. It doesn’t make headlines. But when everything else feels shaky, I like knowing that I have exposure to a centuries-old store of value — and that I’m holding it in the most cost-effective way possible.

Over time, small cost savings add up — and stability becomes priceless.

✍️ How About You?

Do you hold gold in your portfolio?

If so, which ETF did you choose — and why?

👉 Let me know in the comments — I’d love to hear your story or strategy.

Everyone approaches gold a bit differently. Your take might help someone else find their footing.

📎 Related Posts

[ Choosing the Right S&P 500 ETF: SPY vs. VOO vs. IVV vs. SPLG ]

👉 Read Post

[ Where Innovation Lives – A Deep Dive into QQQ and QQQM ]

👉 Read Post

💼 Disclaimer

This blog post reflects my personal opinions and investing experience. It is not intended as financial advice. Please always conduct your own research or consult with a licensed advisor before making investment decisions.

📌 Sharing Policy

You’re welcome to share this post or quote parts of it—please credit the original source and include a link back to this blog. Unauthorized copying, pasting, or full reposting without permission is strictly prohibited.

Privacy Policy

👉 Read Post