Have you ever felt unsure where to park your money when everything seems unstable?

Stocks feel overvalued. Real estate looks risky. Even cash loses value slowly with inflation.

That’s when many investors quietly turn their eyes to gold — not for explosive returns, but for peace of mind.

In a world where headlines change daily and economic forecasts are rarely clear, having something tangible and timeless in your portfolio can feel like anchoring yourself in a storm.

That’s exactly where IAU ETF comes in — a gold-backed fund that’s affordable, trustworthy, and built for everyday investors like us.

📘 1. Basic Information

| Item | Details |

|---|---|

| ETF Name | iShares Gold Trust (IAU) |

| Issuer | BlackRock (iShares) |

| Inception Date | January 21, 2005 |

| Underlying Index | LBMA Gold Price PM |

| Expense Ratio | 0.25% |

| Dividend Yield | None |

| Distribution Frequency | None |

| Current Price (May 2025) | ~$60.94 |

| Avg. Daily Volume | 6M~7M shares |

💡 What is the LBMA Gold Price PM?

IAU tracks the London Bullion Market Association’s PM Fix, a gold price set daily at 3 PM London time through a transparent auction involving global banks. It serves as a globally trusted benchmark for the spot price of physical gold.

📊 Source: LBMA Official Website

✅ 2. Pros of IAU

- Low-Cost Gold Exposure

With a 0.25% expense ratio, IAU is significantly cheaper than GLD (0.40%), making it ideal for long-term investors focused on minimizing fees. - Accessible Price Point

Unlike GLD, which trades above $290, IAU stays around $60, allowing fractional buyers or smaller portfolios to gain meaningful gold exposure. - Trusted Management by BlackRock

IAU is managed by BlackRock, the world’s largest asset manager, which enhances its credibility and transparency. - Tax Efficiency (U.S. Residents)

IAU is structured as a Grantor Trust. There are no internal trades that generate taxable events. Gains are taxed at a maximum 28% rate only when you sell.

📝 Note: Tax rules may vary by country. Always consult your local tax advisor.

⚠️ 3. Cons of IAU

- Lower Liquidity vs. GLD

Although still highly liquid, IAU may have slightly wider bid-ask spreads than GLD, especially in volatile periods. - Not Ideal for Short-Term Trading

It’s built for holding, not flipping. Day traders may find better instruments with more intraday volatility. - No Income or Dividends

IAU does not pay dividends. Your total return is purely based on the price movement of gold. - Non-Productive Asset

Gold doesn’t generate earnings like stocks or bonds. It serves as a hedge or store of value — not a growth vehicle.

📈 4. Historical Performance

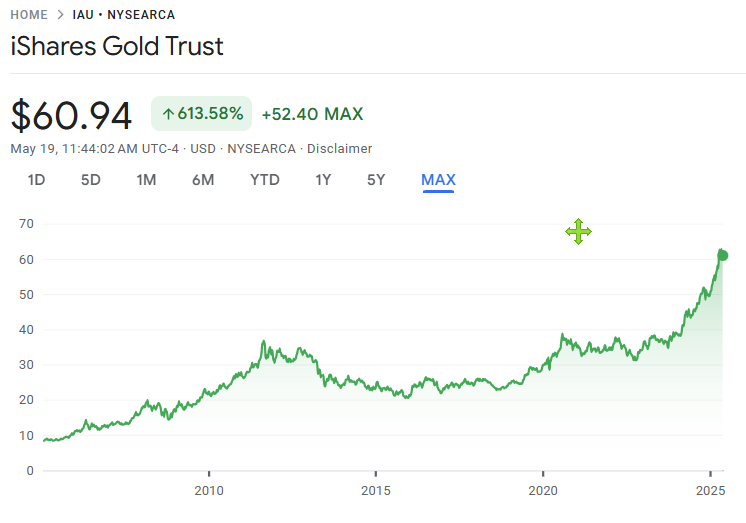

Historical performance of IAU – Over 613.58% growth since inception (Source: Google Finance)

| Period | Return |

|---|---|

| 1-Year (2024–2025 YTD) | +21.3% |

| 5-Year Average | +9.1% annually |

| 10-Year Average | +6.5% annually |

| Since Inception (2005–2025) | ~+240% total return |

While not explosive, IAU reflects gold’s steady performance during inflationary pressure, financial instability, and global crises.

📊 Source: Morningstar IAU Performance Page

💵 Dividend Growth

- Not Applicable

IAU does not pay dividends, as it holds physical gold rather than income-generating assets.

Instead, investors benefit from gold’s scarcity, global demand, and role as a hedge against currency devaluation.

📊 Sector Allocation & Holdings

| Category | Details |

|---|---|

| Asset Type | Physical Gold |

| Holdings | 1 (100% gold) |

| Storage | Authorized vaults in New York, London, and Zurich |

| Verification | Independent audits and monthly reports by BlackRock |

IAU gives you direct ownership of fractional physical gold without needing personal storage.

📊 Source: iShares IAU Overview

🔄 Rebalancing Schedule

IAU does not rebalance like stock ETFs. Since it holds a single commodity, its value rises or falls directly with the price of gold.

🔍 Transparency Note:

BlackRock publishes monthly reports showing the total amount of gold held, storage fees, and all trust-level expenses. This ensures full transparency.

📊 Source: IAU Monthly Report – BlackRock

Note: While gold ETFs like IAU don’t require rebalancing, monthly reports serve as transparency tools to confirm the trust’s actual gold holdings and expenses.

💬 Final Thoughts

Uncertainty changes the way we think about investing.

When markets wobble, currencies weaken, or global risks rise, the appeal of tangible assets becomes clear.

IAU doesn’t promise rapid gains or exciting news headlines.

What it does offer is peace of mind: low cost, physical gold exposure, and the trust of the world’s largest asset manager.

For long-term investors who want to balance growth assets with something durable, IAU might be one of the smartest “quiet” choices out there.

📎 Related Posts

[ GLD ETF: The Easiest Way to Invest in Gold ]

👉 Read Post

[ GLDM ETF Review: The Most Affordable Gold ETF for Long-Term Investors ]

👉 Read Post

💼 Disclaimer

This blog post reflects my personal opinions and investing experience. It is not intended as financial advice. Please always conduct your own research or consult with a licensed advisor before making investment decisions.

📌 Sharing Policy

You’re welcome to share this post or quote parts of it—please credit the original source and include a link back to this blog. Unauthorized copying, pasting, or full reposting without permission is strictly prohibited.