🤔 Why Do So Many Investors Choose SPY?

When you first start exploring ETF investing, there’s one name that shows up again and again — SPY.

It’s not just popular. With a long history and solid performance, SPY has become one of the most iconic ETFs in the world. But now that we’re in 2025, is it still the smartest choice?

In this post, we’ll take a deep dive into SPY and help you decide if it deserves a spot in your portfolio.

📌 Basic Information

| Category | Details |

|---|---|

| ETF Name | SPDR S&P 500 ETF Trust |

| Ticker | SPY |

| Issuer | State Street Global Advisors (SSGA) |

| Inception Date | January 22, 1993 |

| Index Tracked | S&P 500 Index |

| Replication Method | Full replication (Unit Investment Trust structure) |

| Total AUM | $550+ billion (as of 2025) |

| Number of Holdings | 500 |

| Expense Ratio | 0.0945% |

| Dividend Frequency | Quarterly (March, June, September, December) |

| Average Daily Volume | Over 90 million shares |

📊 Data Point + 👉 Source: State Street – SPY Overview

✅ Advantages

- The First ETF Ever

Launched in 1993, SPY is the original ETF. It’s battle-tested and time-proven. - Extreme Liquidity

With massive daily volume and tight bid-ask spreads, SPY is a favorite for both long-term investors and active traders. - Precise Index Tracking

SPY holds all 500 stocks in the S&P 500 by market cap, offering true index exposure. - Automatic Rebalancing

SPY updates its holdings to match the S&P 500 index quarterly — no manual effort required from investors. - Transparent and Reliable

Holdings are disclosed daily, and the structure is simple and easy to understand.

📊 Data Point + 👉 Source: Morningstar – SPY ETF Overview

⚠️ Considerations

- Higher Expense Ratio

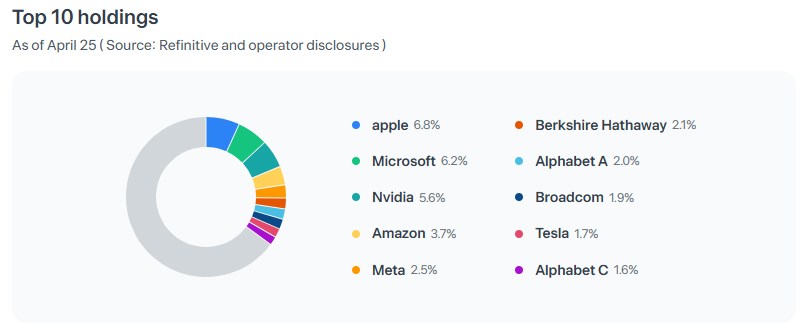

SPY charges 0.0945%, while alternatives like VOO (0.03%) and SPLG (0.02%) are much cheaper — a key factor for long-term investors. - Top-Heavy Exposure

As a market-cap weighted fund, SPY heavily leans on mega-caps like Apple, Microsoft, and Nvidia. - UIT Structure Limitations

SPY’s structure doesn’t support automatic dividend reinvestment (DRIP), unlike many other ETFs.

📊 Data Point + 👉 Source: ETF.com – SPY Analysis

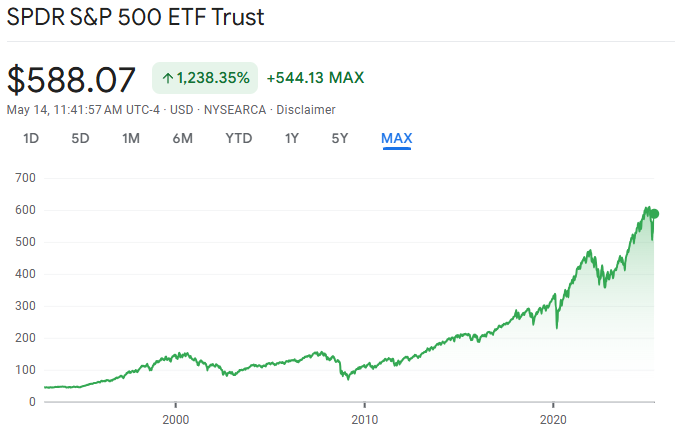

📊 Historical Performance (Total Return)

-Historical performance of SPY – Over 1,238.35% growth since inception (Source: Google Finance)

| Period | Avg. Annual Return |

|---|---|

| 5 Years | ~12.0% |

| 10 Years | ~12.7% |

| Since Inception | ~10.3% (1993–2025) |

📊 Data Point + 👉 Source: Google Finance – SPY

SPY offers consistent dividend payments backed by the earnings strength of America’s top 500 companies. While its yield isn’t the highest, its steady growth makes it attractive for long-term investors.

- Trailing 12-Month Yield: 1.27%

- Annual Dividend (2025): $7.17 per share

- Dividend Schedule: Quarterly — March, June, September, December

📈 Dividend Growth (Compound Annual Growth Rate – CAGR):

| Time Period | Growth Rate |

|---|---|

| 3-Year CAGR | 6.56% |

| 5-Year CAGR | 5.27% |

| 10-Year CAGR | 6.91% |

| 20-Year CAGR | 7.63% |

📊 Data Point + 👉 Source: Digrin – SPY Dividend Growth

These growth rates reflect a healthy trend of increasing dividend payouts over time — signaling the long-term financial strength of the S&P 500 companies that SPY holds.

🧬 Sector Allocation and Top 10 holdings (as of May 2025)

Top 10 Holdings of SPY as of April 2025 (Source: Toss Securities)

| Sector | Weight |

|---|---|

| Information Technology | 30.91% |

| Financials | 14.52% |

| Consumer Discretionary | 10.42% |

| Health Care | 10.16% |

| Communication Services | 9.35% |

| Industrials | 8.69% |

| Consumer Staples | 6.03% |

| Energy | 3.16% |

| Utilities | 2.55% |

| Real Estate | 2.22% |

| Materials | 1.99% |

📊 Data Point + 👉 Source: State Street – Sector Breakdown

🔄 Rebalancing Details

- Rebalancing Frequency: Quarterly (March, June, September, December)

- Typical Rebalancing Date: Third Friday of the quarter

- Annual Reconstitution: Based on eligibility criteria

📌 Example:

In December 2024, Apollo Global, Workday, and Lennox International were added; Catalent, Amentum Holdings, and Qorvo were removed.

📊 Data Point + 👉 Source: S&P Dow Jones – Index Methodology

🧠 My Take: Why I Personally Choose SPLG Over SPY

There’s no question — SPY is one of the most reliable and widely trusted ETFs in the world. It’s great for instant exposure to America’s top 500 companies, and it trades more like a stock than almost any other ETF out there.

But personally, I prefer SPLG — which tracks the exact same index with a much lower expense ratio of just 0.02%. It gives me the same exposure, strong liquidity, and full transparency — but in a more cost-effective package.

For long-term investors, those small fee differences really add up. That’s why SPLG is my go-to core holding for the S&P 500.

That said, SPY remains the gold standard in many ways. If you value legacy, liquidity, and institutional trust — you can’t go wrong with it.

🔗 Related Posts

- VOO ETF: The Vanguard Way to Long-Term Wealth

👉 Read Post

- SPLG ETF: The Most Efficient Way to Own the S&P 500?

👉 Read Post

- Choosing the Right S&P 500 : SPY vs. VOO vs. IVV vs. SPLG

👉 Read Post

- SCHD ETF Deep Dive (2025): The Smart Pick for Dividends and Long-Term Growth

👉 Read Post

💼 Disclaimer

This blog post reflects my personal opinions and investing experience.

It is not intended as financial advice. Please always do your own research or consult with a licensed advisor before making investment decisions.

📌 Sharing Policy

You’re welcome to share this post or quote parts of it — as long as you credit the original source and include a link back to this blog.

Unauthorized copying, pasting, or reposting in full without permission is strictly prohibited.