-Historical performance of SOXX – Over 830.77% growth since inception (Source: Google Finance)

Semiconductors power everything — from artificial intelligence and data centers to smartphones, electric vehicles, and even the very AI you’re using to read this post.

If you’re looking for a simple yet powerful way to invest in this essential sector, SOXX ETF is one to consider.

Let’s take a deep dive into what SOXX is, how it works, and whether it fits into your long-term strategy.

1) Basic Information

Issuer: iShares (BlackRock)

Launch Date: July 10, 2001

Underlying Index: ICE Semiconductor Index

→ This index tracks 30 leading semiconductor companies based on market cap and liquidity.

It includes businesses across the full semiconductor value chain: chip design (fabless), manufacturing (foundry), and equipment suppliers.

Expense Ratio: 0.35%

Dividend Frequency: Quarterly

Dividend Yield: Around 0.8% (as of May 2025)

Share Price: Around $214.17

Average Daily Volume: About 1 million shares

2) Pros 👍

- Pure Semiconductor Focus: Includes top players like Nvidia, AMD, Broadcom, and Qualcomm.

- Exposure to High-Growth Themes: AI, autonomous driving, 5G, and more.

- Easy Access: No need to pick individual stocks — this ETF covers the sector broadly.

- Strong Long-Term Returns: Despite market cycles, the overall trend has been upward.

- Quarterly Rebalancing: Keeps the portfolio aligned with market shifts and prevents over-concentration.

Cons 👎

- High Volatility: The semiconductor industry is cyclical and can swing sharply during downturns.

- Relatively High Expense Ratio: 0.35% is on the higher side among tech ETFs.

- Sector Concentration Risk: It focuses only on semiconductors, so diversification is limited.

- No Exposure to Tech Giants: Major companies like Apple, Microsoft, and Amazon are not included. You’ll need other ETFs to cover them.

- High Share Price: At over $200 per share, it may be less accessible for those starting with small capital.

3) Historical Performance (Annualized Returns)

1-Year Return: ~48%

10-Year Avg Return: ~23%

5-Year Avg Return: ~27%

As of May 2025, according to ETF.com and BlackRock

4) Dividend Growth

While SOXX is primarily a growth-focused ETF, it still offers consistent dividends.

- 2020: $1.32

- 2024: $1.76

→ 33% increase, or about 7.4% CAGR

5) Sector Breakdown & Holdings

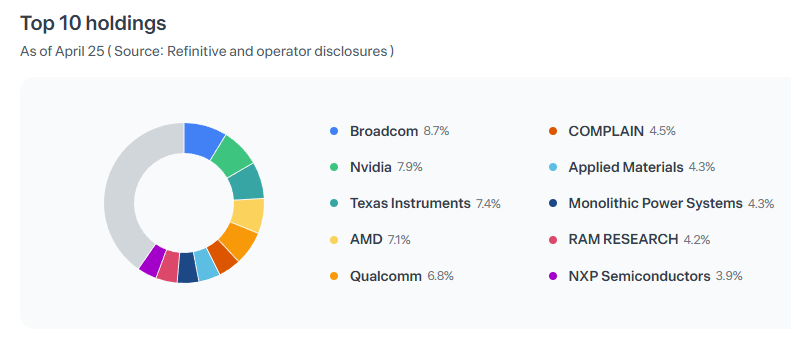

SOXX holds 30 stocks across the semiconductor space.

Most holdings are large-cap companies, with a few mid-caps included.

Top 10 Holdings of SOXX as of April 2025 (Source: Toss Securities)

The fund provides balanced exposure to chip design, fabrication, and equipment — covering the full ecosystem.

6) Rebalancing Rules & Real-World Examples

- Frequency: Quarterly (4 times a year)

- Method: Adjusts weights based on market cap and liquidity

📌 Example:

- In June 2023, Nvidia’s sharp rise led to a significant increase in its weight.

- In late 2022, Intel’s weaker performance caused its weight to shrink, while growth companies like Marvell gained more presence.

SOXX is structured to adapt quickly to market movements while staying diversified within the sector.

7) Final Thoughts

SOXX’s recent surge in returns was mainly driven by the explosive growth of Nvidia and Broadcom.

However, it’s important to remember that this kind of performance is not guaranteed to continue.

The semiconductor industry follows a well-known cyclical pattern:

- During demand booms, profits and stock prices can soar,

- But in downturns or inventory corrections, the sector often sees sharp declines.

That said, semiconductors remain the backbone of modern innovation — powering AI, cloud computing, smartphones, electric vehicles, robotics, and more.

If you believe in the growth of these technologies, then SOXX could be a strategic way to gain targeted exposure.

8) What’s Next? 🚀

In the next post, I’ll introduce another semiconductor ETF: SMH.

While it shares the same sector, SMH has different holdings, structure, and cost.

If you’re wondering how it stacks up to SOXX — stay tuned!

9) Disclaimer & Closing Note

Just to be clear — I’m not a financial advisor. I’m simply sharing my personal investing journey here. Please do what feels right for you. 🙂

Thanks for reading — and as always, invest smart and stay consistent.

See you in the next post! 🚀

Step by step — that’s how we build something lasting.

🔗 Sharing is welcome — but please credit the source (investorJB.com) when you do.